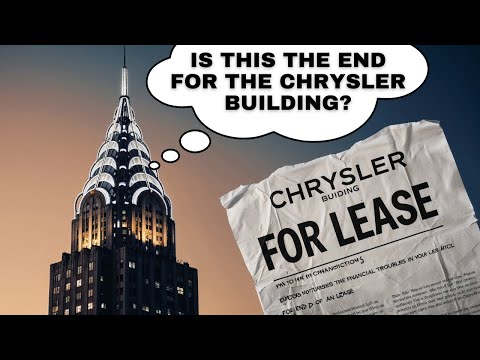

The Chrysler Building is a renowned symbol in the Manhattan skyline, known for its striking Art Deco design and gleaming spire. This New York City landmark has long been admired for its architectural beauty and historical significance.

However, recent developments threaten its future, sparking widespread concern among fans of architecture and city history alike.

Today, the Chrysler Building faces financial challenges that cast uncertainty on its path forward. Its owner-operator, RFR Holding, has failed to pay rent, leading Cooper Union, which holds land use rights, to demand a significant back payment of more than $21 million.

This financial dispute has led to the termination of the building’s ground lease, leaving its future hanging in the balance (https://www.nytimes.com/2024/10/23/realestate/chrysler-building-lawsuits-cooper-union.html).

Compounding these financial woes is a broader issue affecting many office spaces in New York City. The post-pandemic shift in workplace habits has caused high vacancy rates and plummeting demand for office space, hitting iconic buildings like the Chrysler Building hard.

As New York navigates this changing landscape, the Chrysler Building’s fate remains a critical topic of interest for many observers (https://www.msn.com/en-us/money/news/office-market-collapse-hits-nyc-hard-chrysler-building-at-risk/vi-AA1sVg14).

Historical Significance of the Chrysler Building

The Chrysler Building stands as a masterpiece of Art Deco design, crafted by architect William Van Alen. It greatly influenced New York City’s skyline and became an iconic symbol of the city during the early 20th century.

Design and Construction by William Van Alen

William Van Alen’s innovative design marked a pivotal moment in architectural history. He was commissioned by Walter P. Chrysler, founder of the Chrysler Corporation, in the late 1920s to create a skyscraper that embodied luxury and modernity.

The building’s design features Art Deco elements such as geometric shapes and decorative metalwork, especially its famous spire.

The Chrysler Building was completed in 1930 and was briefly the world’s tallest structure before being surpassed by the Empire State Building. Its eye-catching spire and detailed façade reflected the spirit of the Roaring Twenties. The structure remains a defining achievement in both architectural function and form, showcasing the peak of Art Deco style.

Book Your Dream Vacation Today

Flights | Hotels | Vacation Rentals | Rental Cars | Experiences

Impact on New York City Skyline

The Chrysler Building had a transformative impact on the New York City skyline. Standing at 1,046 feet with 77 floors, it was a significant addition to Manhattan’s vertical landscape.

Its unique silhouette and metallic crown quickly became iconic, capturing the imaginations of both residents and visitors.

As a landmark, it symbolized progress and modernity during a time of economic uncertainty. The Chrysler Building’s towering presence offered a sense of optimism, pointing towards a promising future. Even today, it remains a beloved fixture of the city, consistently drawing admiration and making it a must-see destination for those interested in the history of architecture.

Economic and Legal Aspects

The Chrysler Building is facing complex challenges that include legal disputes and financial difficulties. Ownership issues with Cooper Union add to the ongoing tension with the real estate market dynamics. These aspects have significantly influenced the building’s current and future prospects.

Ground Lease and Ownership Challenges

The Chrysler Building, a renowned New York City landmark, faces ownership issues due to its complex ground lease agreement. The land beneath the building is owned by Cooper Union, while the building itself is owned by RFR and SIGNA. This separation has led to significant challenges, especially as Cooper Union attempts to enforce changes in the lease terms or even remove the current owners.

These ownership complications have created a legal and financial tug-of-war that affects the building’s management and future planning. Such disputes are critical, influencing potential investors and complicating any major developmental plans for the building.

Financial Struggles and Ground Rent Issues

Financial challenges have mounted for the Chrysler Building, particularly with the increase in ground rent. The building’s owners, RFR and SIGNA, acquired the property for $150 million, but they face difficulties in handling the escalating rent payments to Cooper Union.

These financial burdens have led to strained relationships and public attention. As the real estate market in New York evolves, the high operational costs and vacancy rates add pressure. This financial strain threatens the economic viability of maintaining and upgrading the building, complicating efforts to attract new tenants and investors.

Legal Battles and Ownership Transitions

Ongoing legal battles have become a defining feature of the Chrysler Building’s recent history. The eviction threats from Cooper Union against RFR and SIGNA have escalated into lawsuits, bringing the New York State Supreme Court into play.

These legal disputes, including those led by notable real estate figure Aby Rosen of RFR, look to address ownership rights and financial obligations. Tishman Speyer, a former owner, previously navigated similar challenges.

The revolving door of legal issues has created uncertainty in market perception and investor confidence, affecting potential developmental and operational strategies related to this iconic structure.

Current Status and Future Outlook

The Chrysler Building, a notable fixture in Manhattan, faces significant challenges as its occupancy rates fluctuate, and its future increasingly hinges on potential redevelopment or sale. The property management decisions and investment strategies will shape its vision for the future, considering both market demands and its iconic status.

Occupancy and Vacancy Rates

The Chrysler Building’s occupancy has been severely affected by changing demands in New York City, especially in the context of a struggling office market. Heightened vacancy rates are linked to the general downturn in commercial real estate after the pandemic.

Many office spaces in Manhattan are seeing similar challenges as companies reassess their space needs. The building’s current financial strain is partly due to its diminished rent income, placing pressure on its owners, including RFR Holding.

While efforts to attract new tenants are ongoing, the effectiveness of these strategies remains to be seen.

Potential for Redevelopment or Sale

There is growing interest in the potential redevelopment or sale to better align with current market expectations. The Chrysler Building’s architectural value offers opportunities for innovative investors.

Signa Holding’s recent legal challenges highlight the financial instability impacting ownership dynamics.

Potential buyers, such as the Abu Dhabi Investment Council, may see opportunities for refurbishment or repositioning amidst current real estate trends. Developer Michael Fuchs and RFR Holding could work on revitalizing the building to attract modern tenants, ensuring it remains a viable investment.

Vision for Future Use

Looking ahead, the Chrysler Building’s iconic status offers a unique vantage point for reimagining its purpose.

The possibility of creating a landmark destination, either by revamping office spaces or incorporating more public amenities like the historic Cloud Club, is enticing.

Emphasizing its historical significance could draw tourists, while adapting to flexible office demands might increase its appeal to creative industries, such as the Creative Artists Agency.

By refining its property management approach, the building could harmonize its past with contemporary economic requirements, ensuring it remains a cornerstone of Manhattan’s skyline for future generations.

Book Your Dream Vacation Today

Flights | Hotels | Vacation Rentals | Rental Cars | Experiences